Early Warnings That Actually Arrive Early

Move beyond late alerts and false positives. Discover how RDC.AI’s Early Warning solution helps banks act up to 6 months sooner, with the clarity and confidence to support customers before stress becomes distress.

Explore Resources >

The Problem

Too many “early” warning systems don’t live up to their name: alerts arrive only after problems are obvious, false positives create noise and fatigue, and backward-looking data leaves banks exposed. If this sounds familiar, you’re not alone.

Late Alerts

Signals fire after the issue is visible

Noise

High false positives reduce confidence

Lagging Data

Financials alone miss early behaviour

The AI-powered Advantage

Early Warnings via the RDC.AI explainable decisioning platform gives banks:

AI-powered Predictions

Spot risks up to 6 months earlier

Transactional Intelligence

Visibility into cash flow and behavioural patterns

Customer-to-Portfolio Insights

Risk signals aggregated into a clear portfolio view

Explainable AI

Every alert backed by transparent reasoning

Continuous Learning

Self-improving models that reduce false positives

Workflow Integration

Insights where bankers already work

Why It Matters

When early warnings work, your teams can:

Intervene earlier to support struggling customers

Free up time for growth conversations with healthy clients

Improve capital allocation and provisioning accuracy

Build trust with regulators and stakeholders

“Early Warnings from RDC.AI is helping our bankers ‘see around corners’ – enabling earlier, more informed conversations with customers.”

– Peter D’Arcy, Senior Executive Vice President – Head of Commercial Banking, M&T Bank

Explore the Resources

Dive deeper into the pitfalls and possibilities of effective early warnings:

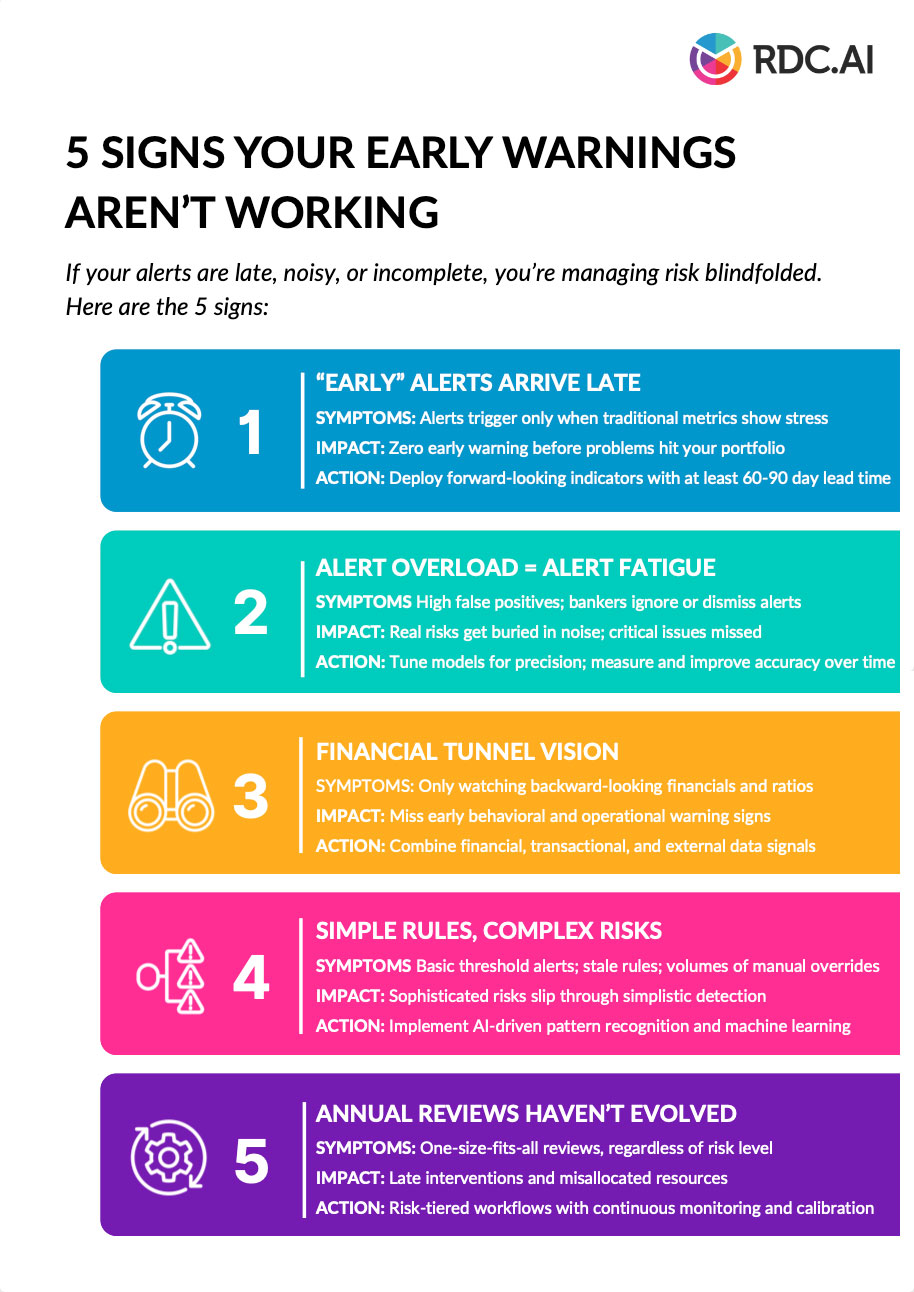

5 Signs Your Early Warnings Are Failing You

Alert fatigue? Late notifications? Missed risks? Your early warning system might be working against you.

This infographic exposes the 5 critical warning signs and reveals how AI-powered systems deliver early warnings up to 6 months ahead of problems – while reducing false positives.

Download now to transform your risk management from reactive to proactive.

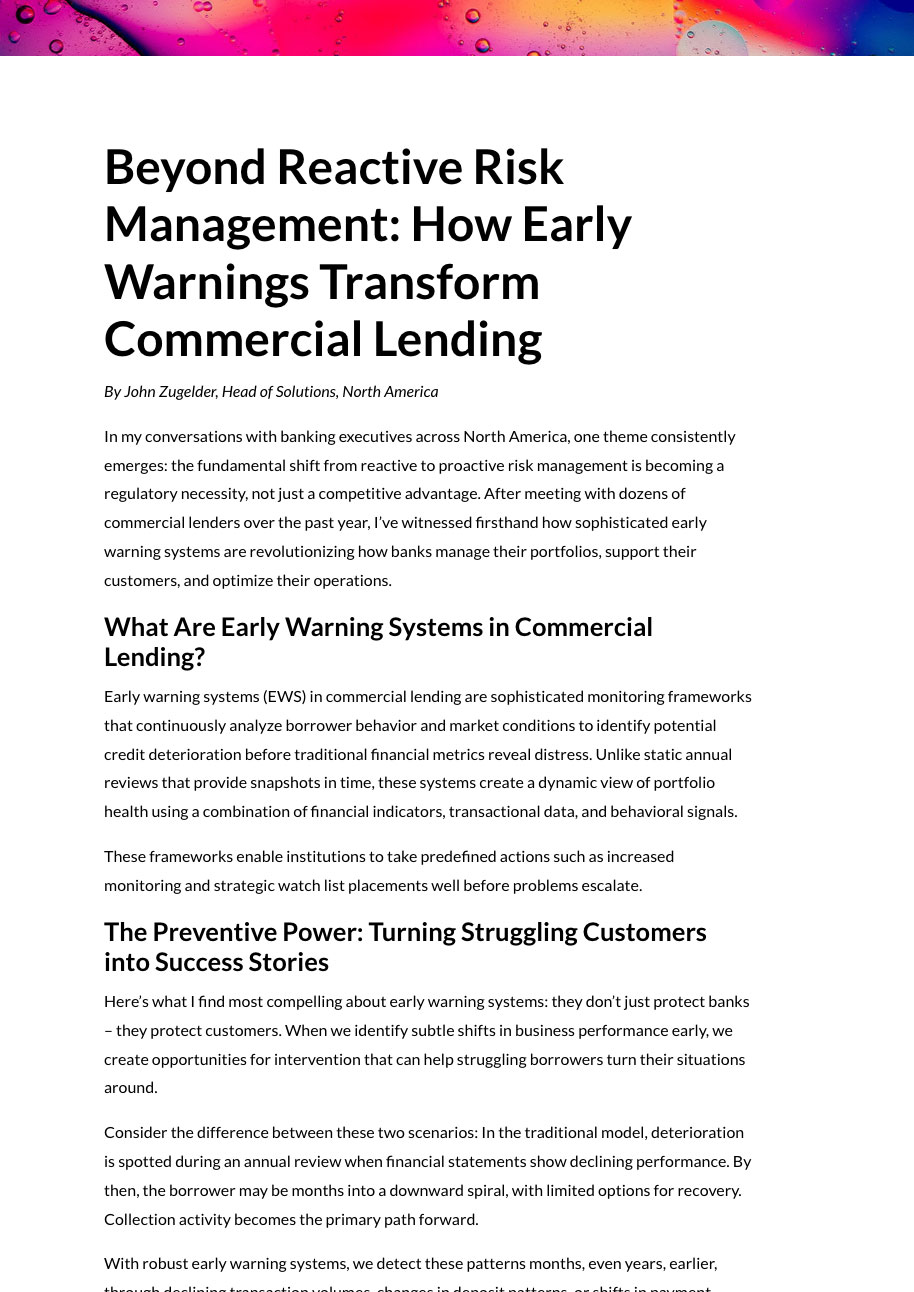

Beyond Reactive Risk Management: How Early Warnings Transform Commercial Lending

Traditional risk management waits for problems to surface – often when it’s too late. What if you could spot emerging risks six months before they impact your portfolio?

This resource explores how AI-powered early warning systems are transforming commercial lending from reactive damage control to proactive opportunity management. Discover why leading banks are moving beyond periodic reviews to continuous, AI-powered risk intelligence that protects portfolios and unlocks growth.

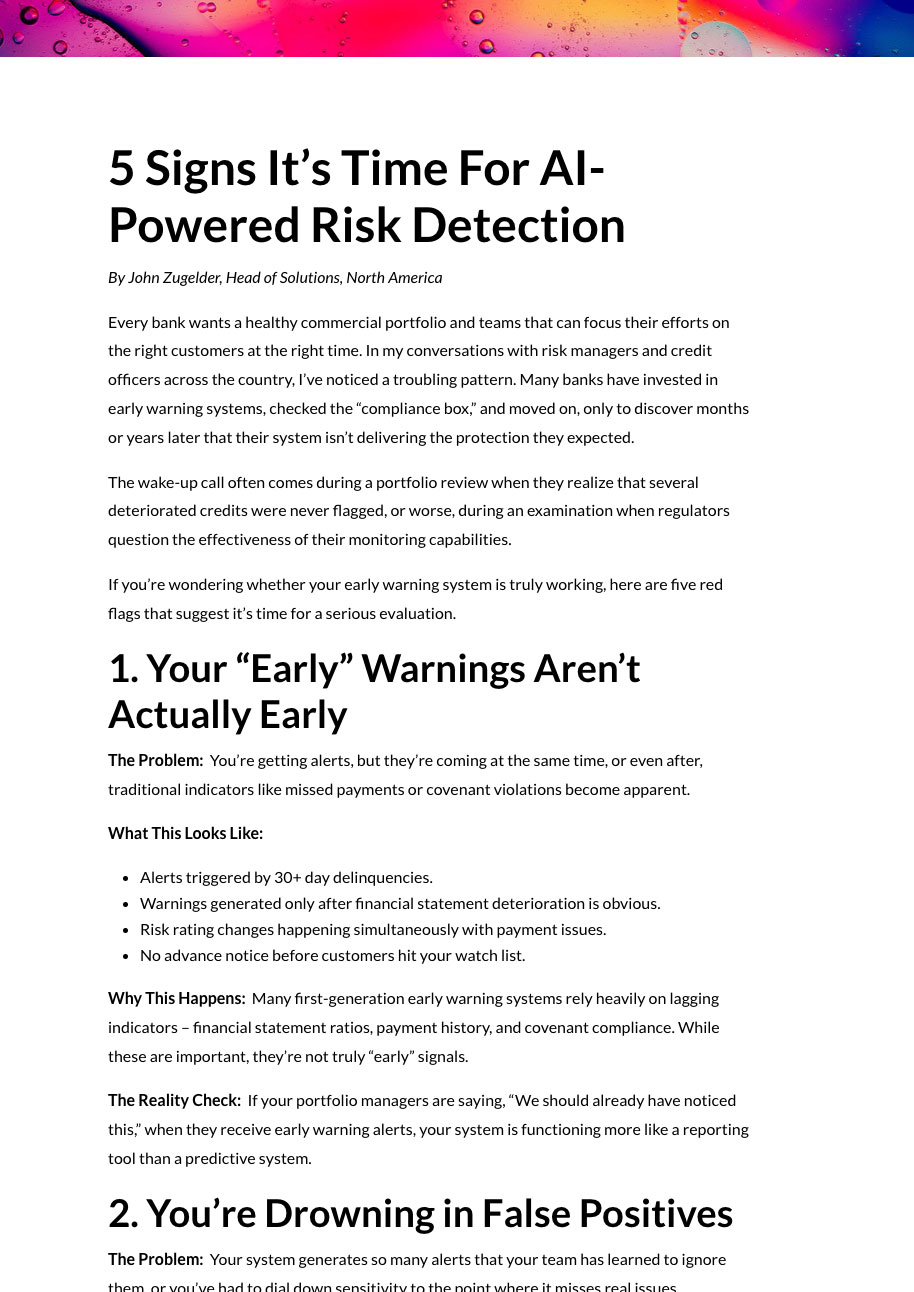

5 Signs It’s Time For AI-Powered Risk Detection

Your current risk management might be missing critical warning signals. From delayed data updates to blind spots in portfolio monitoring, outdated detection methods leave lenders vulnerable to emerging threats.

This resource reveals five clear indicators that it’s time to upgrade to AI-powered risk detection. Learn to recognize when manual processes, reactive alerts, and fragmented data are putting your portfolio at risk – and discover how intelligent automation can transform your risk management from a necessary cost center into a competitive advantage.

Request Your Early Warning Assessment

Complete the form to connect with us for a complimentary assessment of your current capabilities – and a roadmap to stronger, more proactive portfolio management.