While mandatory customer reviews are essential, they are often time-consuming for lenders. Our Automated Reviews solution optimises this process by automating assessments for low-risk business and commercial customers and providing explainable insights for those at higher risk. This enables relationship managers to have purposeful, proactive risk management discussions.

Key Benefits

Reduce risk

Enhanced risk oversight through auditable, transparent and traceable review processes that help you focus on the right customers at the right time.

Increase efficiency

Transform time-consuming manual reviews into efficient, automated operations that save time and reduce operational costs.

Improve decision-making

Leverage the latest, continually updated data to assess the current and future credit health of your customers.

Enhance customer relationships

Equip your team with the insights necessary for proactive, purpose-driven conversations that help mitigate risk and strengthen customer relationships.

How it works

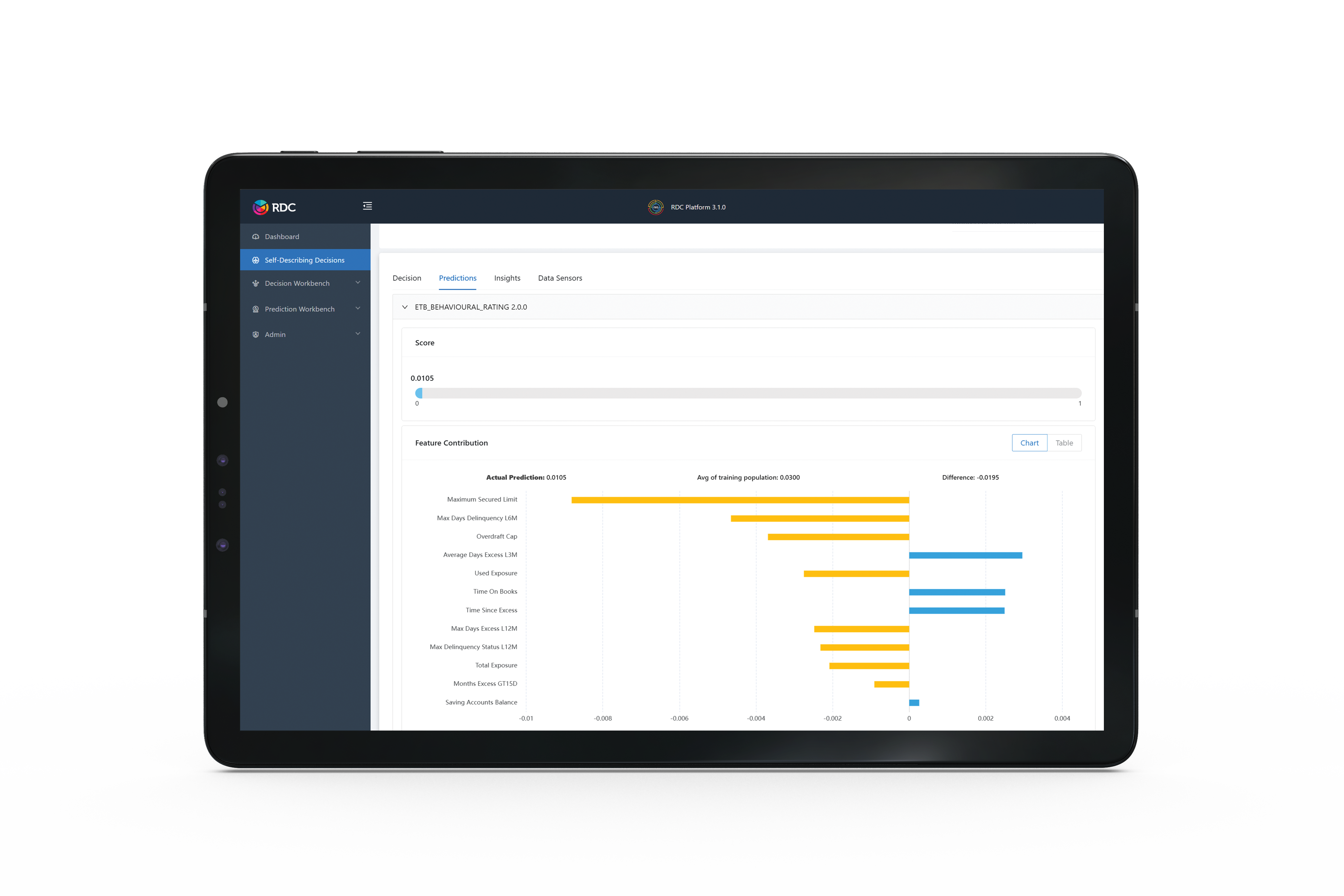

Automated Reviews leverages the RDC.AI decisioning platform, which uses a blend of traditional, latent, and alternate data to deliver insights for more predictive decision-making. The platform combines all elements of credit assessment in one place, continuously monitors customer data, and provides clear explanations for AI-based recommendations, to help stakeholders understand the reasoning behind them.

Features overview

Transparent, explainable credit decisions

AI-powered early risk detection

Portfolio-level risk heatmaps

Intuitive internal policy rule configuration

Dashboard with customer insights, predictions and benchmarks

Transformations enabled by Automated Reviews

From

To

Regulatory compliance

Proactive operational control

Decisions based on outdated, point-in-time data

Decisions informed by continually updated data

‘One-size-fits-all’ approach

Tailored blend of automated and manual reviews

Schedule-based reviews that do not account for risk position

Targeted reviews based on predicted cashflow and risk position

Unproductive customer interactions

Relevant, purpose-driven customer engagements

Customer

success story

A major bank approached RDC.AI to address inefficiencies in its operations, primarily caused by credit managers dedicating too much time to manual review processes, resulting in suboptimal use of personnel and decreased operational efficiency. With the planned implementation of Automated Reviews, the bank is expected to achieve a significant reduction in manual efforts of approximately 50%, which could translate into annual savings of around USD $5.8 million.

Get in touch

Discover how Automated Reviews can transform your risk management practices.