The volume of information available today presents many lenders with the challenge of fully leveraging their data, or potentially missing out on opportunities for their business and commercial customers.

Lead Limits utilises AI to analyse comprehensive data sources – including cash flow, seasonality, and repayment habits – to identify new lending opportunities with your existing commercial customer base. By accessing the insights behind these limits, your relationship managers can engage in meaningful conversations with customers and grow their portfolios.

Key Benefits

Unlock new opportunities

Leverage additional data sources to identify untapped

lending opportunities within your portfolio.

Improve the customer experience

Use tailored, data-driven insights to enrich customer

conversations and add value.

Grow sustainably

Grow your existing loan portfolio safely and responsibly by

proactively offering personalised credit limits.

Lend responsibly

Identify additional servicing capacity with existing customers

that align with your organisation’s risk appetite and credit policies.

Increase efficiency

Streamline the origination process with pre-approved limits,

reducing lending time and operational costs.

How it works

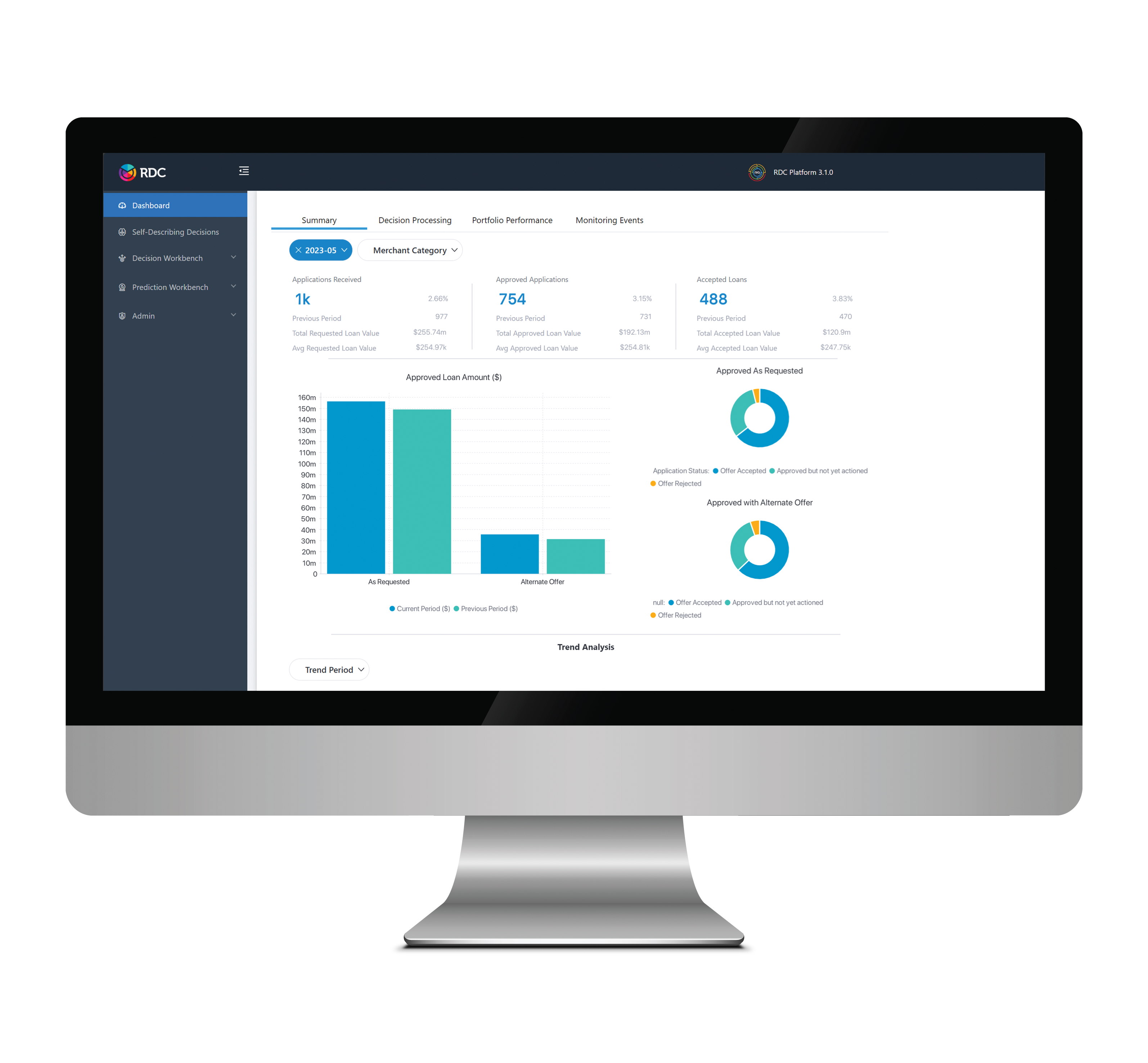

Lead Limits leverages the RDC.AI decisioning platform using traditional, latent, and alternate data to deliver insights for more predictive decision-making. The platform combines all elements of credit assessment in one place, continuously monitors customer data, and provides clear explanations for AI-based recommendations to help stakeholders understand the reasoning behind them.

Features overview

Transparent, explainable credit decisions

AI-powered risk and serviceability assessment

Proactive risk and serviceability pre-assessed limit offers

Intuitive internal policy rule configuration

Dashboard with customer insights, predictions and benchmarks

Transformations enabled by Lead Limits

From

To

Generic limit amounts based on segmentation

Specific limits tailored to individual behaviour and considering existing risk levels

Identified limits outside the origination process

Identified limits within the origination process

Assessment based solely on historical data

Assessment incorporating historical data plus predictions and projections

Customer

success story

A major bank approached RDC.AI to help find opportunities within its existing portfolio to responsibly increase lending limits. Following the planned implementation of Lead Limits, the bank is expected to identify approximately US$1.5 billion in new lending limits, which will have significantly lower risk profiles compared to its previous processes.

Get in touch

Discover how Lead Limits can help you safely expand your loan portfolio for the right customers.