One Platform. Infinite Potential.

Built for business and commercial lending. Trusted by banks that move faster, act with insight, and grow with confidence.

Say goodbye to black-box lending.

RDC.AI’s Decisioning Platform delivers continuous intelligence, predictive insights, and explainable AI in one seamless solution.

We’ve built it specifically for business and commercial banking teams—those who need to move quickly without compromising on transparency, compliance, or control. Whether you’re originating loans, monitoring portfolios, or managing risk, RDC.AI helps you make confident credit decisions in real time.

What the Platform Delivers

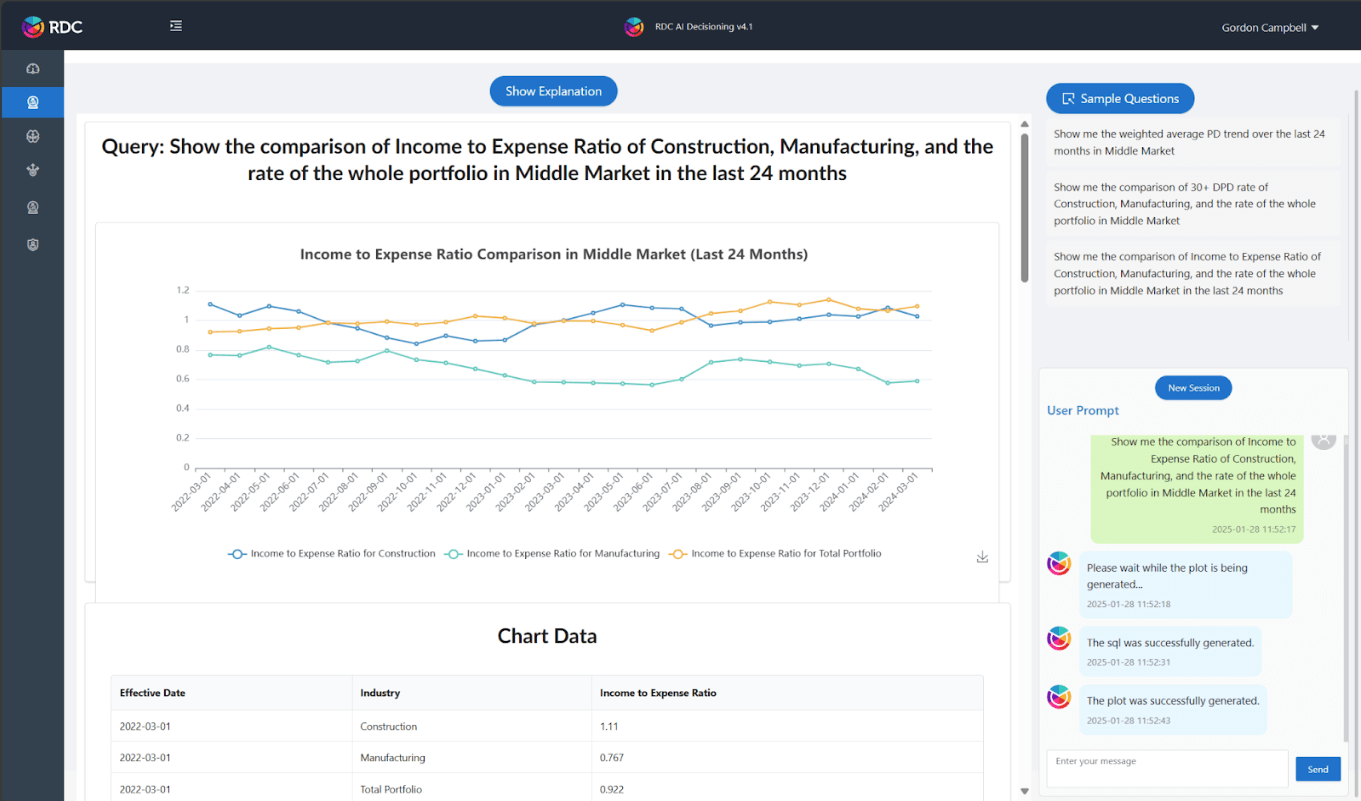

Predictive & Generative AI

Go beyond traditional risk models. Our platform predicts borrower behaviour, predicts future-looking insights, and adapts to change in real time—so you can lend with greater precision and speed.

Self-Describing Decisions

Our decisions come with built-in transparency. Every output is explainable, auditable, and easy to trace. Regulators see what you see. Bankers trust what they’re using.

Continuous Credit Monitoring

Always on. Always one step ahead. Spot potential defaults months in advance and act early to protect your portfolio.

Decision Workbench

Design, simulate, and optimise credit strategies—before you go live. Test scenarios against historical data to see what works, then deploy with confidence.

Predictions & Decisioning

From pre-qualification to renewals, RDC.AI empowers every decision with data-rich predictions. You get faster cycle times and stronger customer outcomes.

Seamless Data Integration

Use your existing systems and bring in transaction data, bureau feeds, and more. Everything connects. Everything works together.

Glass-Box Transparency, Not Black-Box Mystery

Unlike opaque models that leave you guessing, RDC.AI is built on a Glass-Box framework. Every decision is supported by a clear, traceable rationale. It’s explainable AI that gives your credit teams—and your regulators—complete confidence.

Safe. Secure. Scalable.

Built with enterprise-grade security and data governance

Cloud-native design ensures agility and flexibility to meet your evolving needs. Works seamlessly with all major cloud service providers.

ISO 27001 certified, with SOC2 Type 2 accreditation. Supports both SaaS and VPC deployment models.

Deployed across APAC and North America with large Tier 1 and Tier 2 banks.

NAB turns to AI to decide on small business loans.

“We partnered with RDC.AI for their proven ability to innovate, augment and expand our small business lending capability. Their platform enables us to innovate and accelerate our lending options in this market, leveraging alternative data and AI techniques.

Howard Silby

Chief Innovation Officer, NAB

Ready to move faster, with confidence?

Let’s talk about how RDC.AI can transform your lending strategy.